Proactive engagement with activist investors - Towards the upside of ESG risks

Shareholders are increasingly concerned not only with a company’s performance but, also, the way in which it conducts its business. How can management reconcile its duty to optimise returns for these shareholders, while also addressing the issues involved with ESG (environmental, social and corporate governance) reporting and the growing number of challenges being brought by some types of investors?

Examples of existing, mandatory ESG disclosures include:

– Premium listed companies are subject to disclosures based on the TCFD (Task Force on Climate-Related Financial Disclosures, FCA December 2020).

– Larger companies must disclose how the directors fostered the company’s business relationships with suppliers, customers and other stakeholders. They must also advise how its directors engage with the organisation’s employees, with inclusion and diversity now being a particular focus.

– Large companies must also usually include information in their directors’ report on the company’s greenhouse gas emissions and energy consumption for the financial year. (Section 172 of the Companies Act 2006)

With regard to potential the future ESG legislation:

– The UK government has announced plans to introduce new supply chain due diligence obligations in relation to deforestation through the Environment Act 2020, non-compliance with which could result in fines (August 2020).

– The UK government has announced that it intends to make TCFD-aligned disclosures mandatory across the economy by 2025, with a significant proportion of mandatory requirements in place by 2023.

ESG Risks

Without substance in the form of proactive changes in company policy, and the resources and funding to achieve them, companies are now regularly being accused of “green-washing” and mis-selling their ESG credentials. Further, while successful ESG-related litigation claims have yet to be seen in the UK, ESG statements are increasingly being referred to in litigation as a means of trying to establish the liability of UK-based defendants for one or more of the organisation’s overseas operations, as was seen in the recent case of Hamida Begum v Maran (UK) Limited 2021.

Activist shareholders are regularly calling out management during shareholder meetings and seeking seats on the board to redirect company policies in line with their views. For example, in May 2021, with only a 0.02% shareholding, Engine No.1, a small investment firm, staged a boardroom coup of ExxonMobil, successfully installing three directors who have committed to speeding up the company’s energy transition.

Are managements’ duties to optimise returns for their investors at odds with their ESG requirements?

Companies and their directors in England & Wales owe a fiduciary duty to pursue a long-term increase in financial value for the company. Historically this has meant that ESG concerns have often been demoted in favour of boosting company profits. Increasingly, however, ESG factors can directly impact both balance sheets and P&Ls, and a company’s reputation. While we would not expect investors to completely forgo their desire for shorter term investment returns, there is now a clear expectation of responsible, transparent conduct by companies, and strategies that are demonstrably aligned with sustainable, ESG-compliant value creation.

As such, management and boards should proactively seek to recognise the upsides of their ESG risks, working to transition their businesses to achieve investors’ expectations, while minimising the risks of litigation, directors’ liabilities and unwanted attention from activist shareholders.

Taking action

We recommend that your ESG risk improvement planning includes:

– Seeking expert legal advice to identify and articulate your ESG risks, both existing and emerging.

– Future-proofing your business by building planned and potential ESG legislation into the organisation’s strategy, operations and risk management.

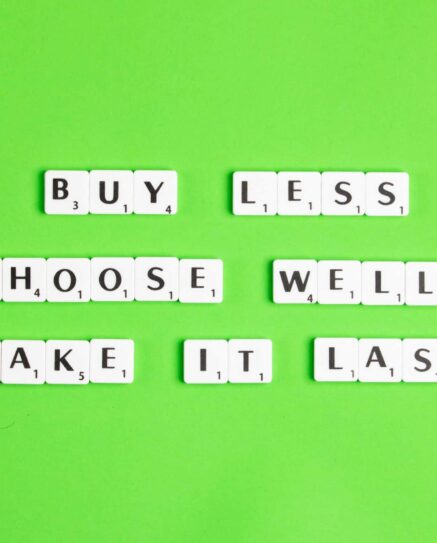

– Actively and creatively thinking about how managing ESG risks can open up new opportunities for the business, differentiating and positioning it ahead of its peers with customers, investors, lenders, business partners and employees.

– Anticipating the ESG disclosure-related expectations of leading investors, and keeping up with relevant competitors with respect to voluntary disclosures.

– Developing ESG emergency response plans to engage with unanticipated shareholder action in a pre-agreed manner.

– Having planned ESG disclosures reviewed in advance by lawyers specialising in this area.

While embedding ESG in the organisation’s values, strategy and operations can be time and resource intensive, it is now becoming a financial enabler, helping to secure new sources of investment and project financing, delivering shareholder value and enhancing the businesses’ reputation and resilience.

Photo by Edward Howell on Unsplash

To learn more and see how we can help, please contact Robert or your usual Jurit contact.

Robert Marcus Partner - Commercial +44 (0) 20 7846 2370 robert.marcus@jurit.comPlease note this paper is intended to provide general information and knowledge about legal developments and topics which may be of interest to readers. It is not a comprehensive analysis of law nor does it provide specific legal advice. Advice on the specific circumstances of a matter should be sought.